A University in Motion. Apply now!

What is the 1098-T form?

Form 1098-T (Tuition Payments Statement) is the information that colleges and universities are required to issue for the purpose of determining a student’s eligibility for the American Opportunity and Lifetime Learning education tax credits. The 1098-T form can be kept with your records and does not need to be sent to the IRS with your income tax return since AUM sends your 1098-T information to the IRS.

1098-T FAQs

The information on this page is general information. AUM does not assist in tax preparation and cannot answer specific tax questions. For tax specific questions, please contact the Internal Revenue Service or a qualified tax advisor for further assistance.

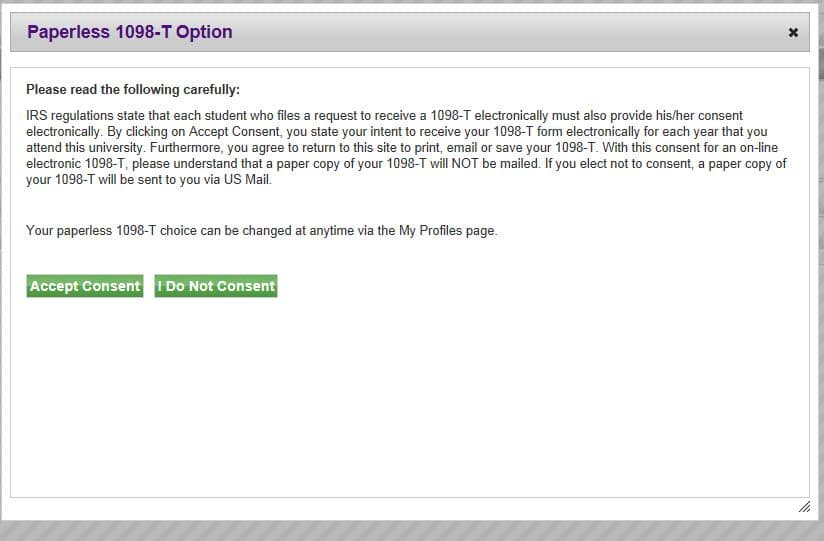

There are two options to receive the 1098-T form. Students can opt in to receive the 1098-T form electronically or they can have a paper copy mailed to the students’ mailing address listed in Webster. If a student chooses to receive the 1098-T electronically, a paper copy will not be mailed. The 2014 1098-T form will be made available by January 31, 2015.

Headline

Donec id elit non mi porta gravida at eget metus. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio

Students have until December 31st to opt in to receive the 1098-T form electronically for the current year. The option to opt in will be made available again for the new year on April 1st. Below are the instructions to receive a paperless 1098-T form:

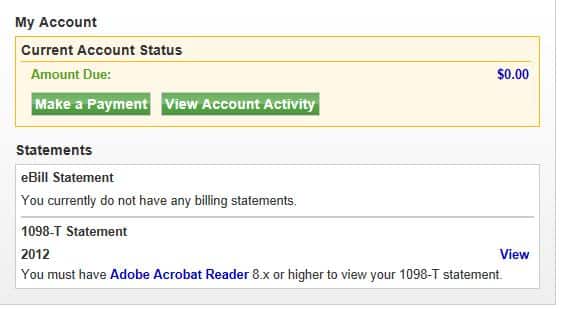

Any 1098-T information that is not available to view in WebPay can be viewed in Webster.

There are several reasons why a student may not have received a 1098-T form.

In WebPay, click on “View Account Activity” and view transactions by each term.